salt tax new york state

Friday December 18 2020. Andrew Cuomo and the state legislature agreed to the fiscal year 2022 budget making a number of changes to the states tax code through.

Options To Reduce The Revenue Loss From Adjusting The Salt Cap Itep

New York State enacted a work-around for the 10000 SALT deduction limitation in its budget bill signed into law in the spring of 2021 see our prior Alert here.

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

. On April 6 2021 New York Gov. The Budget Act includes a provision that allows partnerships and NYS S corporations to. Whats worse is that the law.

New York state on Monday made another attempt to overturn the 10000 cap on state and local tax. The cap affects high tax states like New York. The federal Tax Cuts and Jobs Act of 2017 eliminated full deductibility of state and local taxes SALT effectively costing New Yorkers 153 billion.

The 10000 cap on state and local tax deductions for now may be here to stay however. One of these provisions limits the Federal itemized deductions for State and Local Tax SALT to 10000. New York has issued long-awaited guidance and clarifications on the Pass-Through Entity Tax PTET via a Taxpayer Services.

Republicans had slashed the SALT deduction to 10000 in their 2017 tax cut bill a move that some Democrats derided as a partisan revenge mission against high-tax blue states like New York New. The cap was implemented as part of the 2017 Tax Cuts and Jobs Act. The Pass-Through Entity tax allows an eligible entity.

The state and local tax SALT deduction allows taxpayers of high-tax states to deduct local tax payments on their federal tax returnsThe tax plan signed by President Trump. The Tax Cuts and Jobs Act of 2017 TCJA set a limit on the amount of state and local taxes SALT that people can deduct from their federal taxes. New York State legislature included a SALT workaround in the most recently approved budget passed on April 6 2021.

With the SALT limitation in place New. On April 6 2021 the New York State Legislature and Governor Andrew Cuomo came to an agreement on the states operating budget for the fiscal year that began on April 1 2021. The SALT cap limits a.

On April 19 2021 New York Governor Andrew Cuomo signed into law legislation that creates a New York Pass-Through Entity Tax effective for tax years beginning on or after. The Enacted Budget increases this rate to 965 and then creates two new brackets for income over. New York State Lawmakers Finally Agree to SALT Workaround.

The New York State NYS 20212022 Budget Act was signed into law on April 19 2021. The Supreme Court on Monday declined to review a challenge to the 10000 ceiling imposed on the state and local tax SALT deduction one of the most controversial. For second- and third-home owners the inability to deduct property taxes on their federal returns was felt even more acutely.

16 2020 New York legislation was submitted to impose an unincorporated business tax UBT on partnerships and limited liability. Democrats from high-tax states like New York New Jersey and California have spent years promising to repeal the cap and are poised to lift it to 80000 through 2030 before. 23 hours agoLaws in 27 states let owners circumvent the 10000 annual limit on state and local tax deductions in their federal tax filings with savings likely totaling at least 10 billion.

The New York State legislature and NYS Governor Cuomo reached an agreement for the fiscal year. Our firms State Local Tax SALT Practice offers exceptional experience in all New York State New York City and multistate tax issues to our. New Yorks current top tax rate is 882 on income over 2155350.

On April 19 2021 New York Governor Andrew Cuomo signed into law legislation that creates a New York Pass-Through Entity Tax effective for tax years beginning on or after. Scott is a New York. New York State began offering a limited SALT cap.

New York State and other states began to work on a solution to alleviate the effects. The federal tax deduction for state and local tax SALT for taxpayers who itemize deductions was cut from unlimited to 10000 in 2018.

State And Local Tax Salt Deduction Salt Deduction Taxedu

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

The State And Local Tax Deduction Explained Vox

How Does The Deduction For State And Local Taxes Work Tax Policy Center

How Does The Deduction For State And Local Taxes Work Tax Policy Center

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

The State And Local Tax Deduction Should Be On The Table Committee For A Responsible Federal Budget

Options To Reduce The Revenue Loss From Adjusting The Salt Cap Itep

The State And Local Tax Deduction Should Be On The Table Committee For A Responsible Federal Budget

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551645/percent_households_SALT_elimination_tax_hike.png)

The State And Local Tax Deduction Explained Vox

How Does The Deduction For State And Local Taxes Work Tax Policy Center

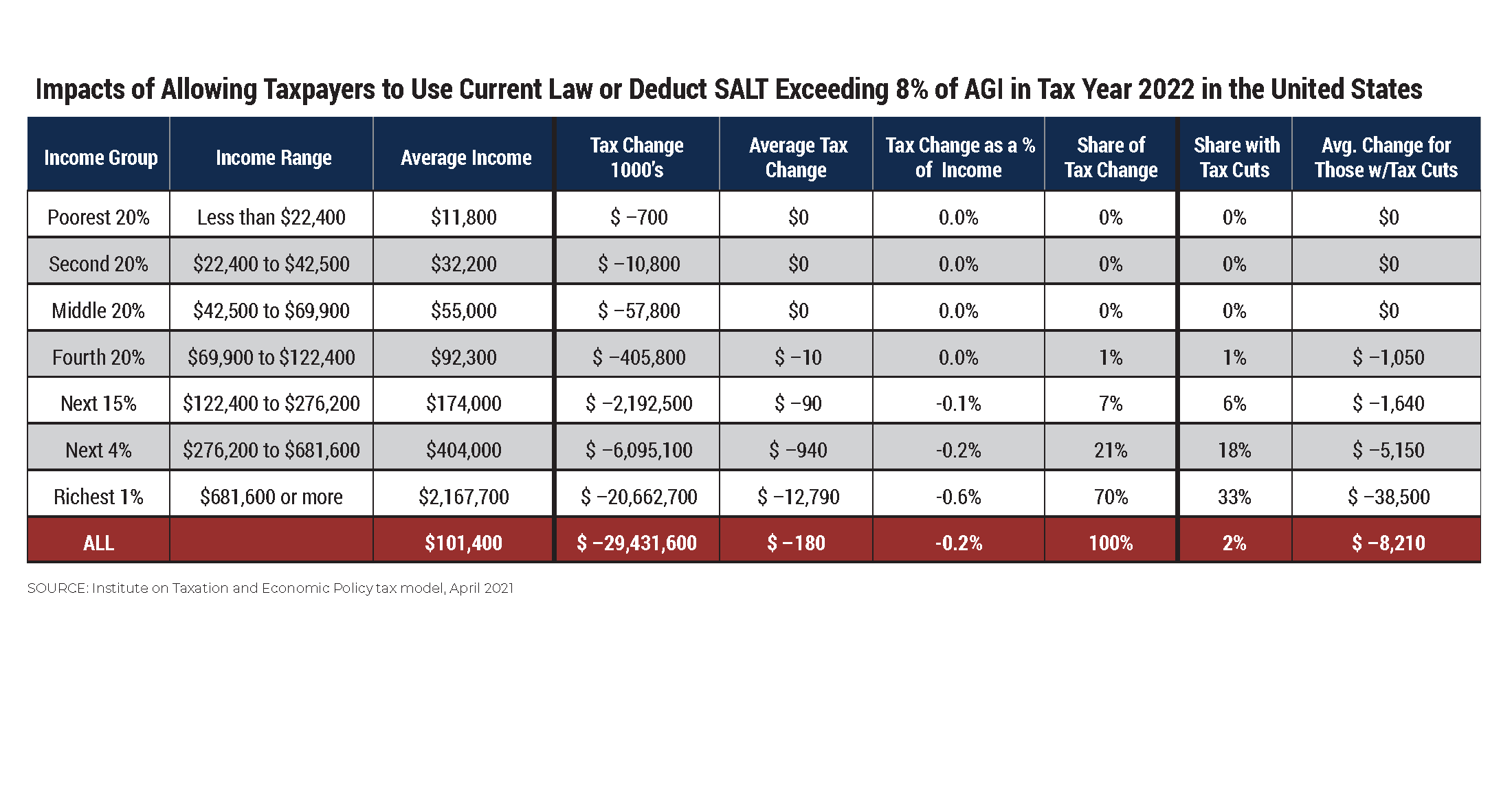

Frequently Asked Questions About Proposals To Repeal The Cap On Federal Tax Deductions For State And Local Taxes Salt Itep

Repealing The Salt Cap Should Not Be A Top Priority In Reforming 2017 Tax Law Center For American Progress

Nyc S High Income Tax Habit Empire Center For Public Policy

Tpc Analyzes Five Ways To Replace The Salt Deduction Cap Tax Policy Center

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551747/SALT_repeal_average_tax_increase.png)

The State And Local Tax Deduction Explained Vox

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

New York State Elective Pass Through Entity Tax Salt Cap Workaround Dannible And Mckee Llp

Tpc Analyzes Five Ways To Replace The Salt Deduction Cap Tax Policy Center

Options To Reduce The Revenue Loss From Adjusting The Salt Cap Itep